On the other hand lower ratio indicates that the company’s profit has reduced and is not utilizing the funds efficiently. Growth in earning per share indicates that by what percentage the earning per share has been increasing in comparison to the previous 12 months.Ī higher ratio indicates that the company’s profitability has increased and it is running its business efficiently. The higher the company’s cash EPS, the better it is considered to have performed over a period. Cash EPSĬash EPS or more commonly operating cash flow per share measures the financial performance of the company.įree from non-cash items like depreciation which is included in basic EPS calculation, cash EPS may prove to be a more reliable measure of the financial and operational health of the company. So, basic earnings per share should be adjusted for the effect of all the dilutive potential ordinary shares. Learn from Market Experts – Macroeconomics made Easy Sometimes in the future company may have entered into obligations that could have diluted the EPS in the future. Diluted EPSīasic earnings per share take into account only those shares in an issue that were outstanding during the period. i.e the company offers extra shares to its shareholders. In order to determine the value of earning from the share, shareholders also calculate EPS in two different ways:īasic EPS does not take into account any dilutive effect that convertible securities have on its EPS.įor example, it does not take into account any right issue or bonus issue. Investors use earnings per share to compare with the share price of the shares to determine the value of earning and how shareholders feel about the future growth of the company. It gives an understanding of the profitability of the company.

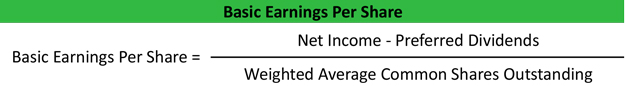

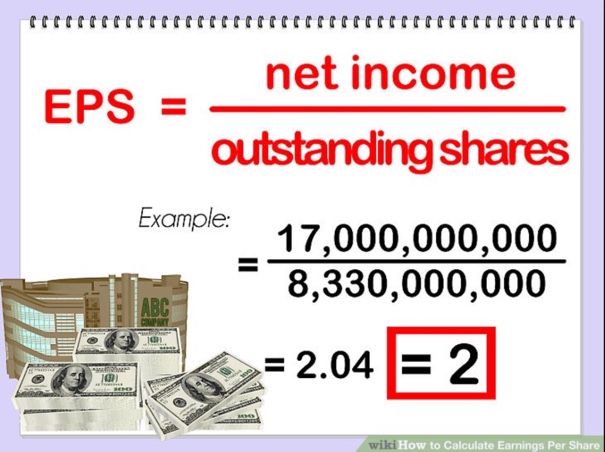

Why Earnings Per Share is Important?ĮPS is very important for all the investors as it indicates that how much income is being earned by each ordinary shareholder. A larger company will have to split its earnings amongst many more shares of stockholders compared to a smaller company. In other words, this is the amount of money each share of stock would receive if all of the profits were distributed to the outstanding shareholders at the end of the year.Ī large company’s profits per share cannot be compared to a small company’s profits per share. What is Earning Per Share (EPS)?ĮPS measures the amount of net income earned per share of stock outstanding. You remove the preferred dividends because EPS shows the earnings for common shareholders only.There are a lot of ratios that help the investor to make any investment decision one such ratio is the earning per share which depicts the efficiency of a company in generating profits from its business venture. The basic EPS calculation is fairly simple, although several variations can lead to different results.įirst, subtract the company's net income (i.e., net profit) from its preferred dividend payments for a specific period - usually a quarter or year.

#Earnings per share formula how to#

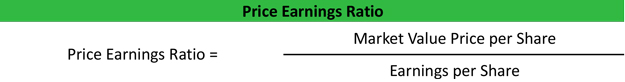

"It's better to compare the EPS for similar companies as the interpretation can be subjective otherwise." How to calculate EPS "EPS can vary greatly from one industry to another, so a good EPS is dependent on the company and expectations for future performance," says Mock. Compare the company's EPS to direct competitors' EPS.īut there's no single number that represents a "good" EPS - it's all relative.

A company's EPS can be important when you're deciding whether to sell, hold, or buy a company's stock.

0 kommentar(er)

0 kommentar(er)